How to Record Journal Entry of Account Payable?Definition and Examples

Any discrepancies will be accounted for and corrections will be made accordingly. The management will assign accounts payable to its sub-sections and plan for the payment terms. At any point in time, the balance of your AP account will show up on your balance sheet alongside other short-term liabilities like wages payable and sales taxes payable.

What Are the Responsibilities of Accounts Payable Manager?

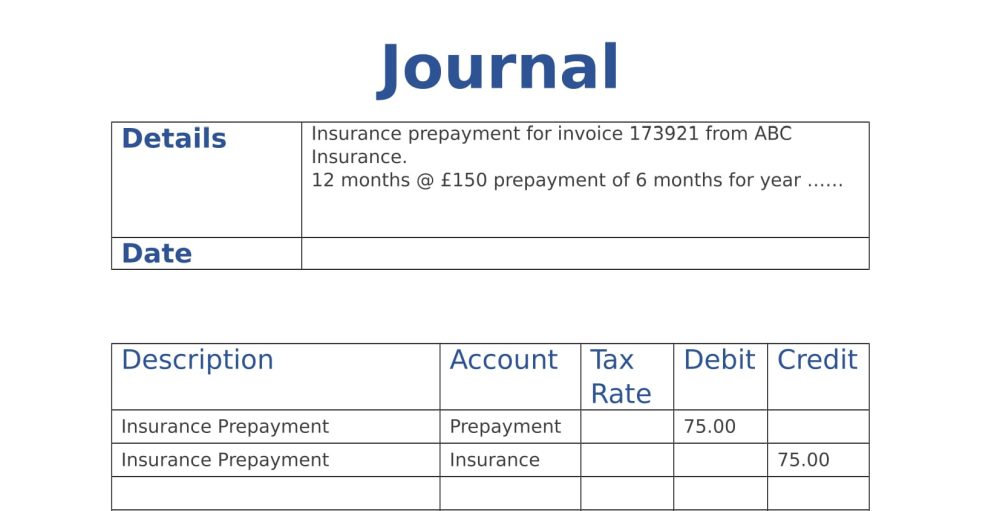

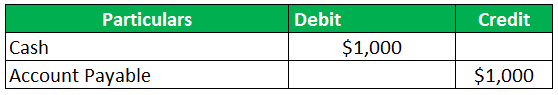

When goods are purchased on credit from a supplier the amount owing to the supplier is recorded as an accounts payable. Subsequently when a payment is made to the supplier for the amount outstanding, the payment of the liability is recorded using an accounts payable payment journal entry. Accounts payable automation will help you to reduce the time and cost of purchase invoice processing. AP automation will also help to reduce human errors and increase efficiency.

Accounts payable vs. accounts receivable

Check out an interactive demo environment to see what Ramp’s financial reporting features can tell you about your business. This report serves as a reminder to use those credits and can even remind you to prioritize certain vendors to make use of your available credits. With your expenditures categorized, you can monitor your spending at both a micro and macro level, checking that you’re adhering to operating budgets. As a bonus, you’ll be better prepared to report your deductible expenses during tax time. Finally the above journal entry is one of many examples of bookkeeping.

How to build and manage your AP reporting process

This account is debited anytime a payment is made and displayed on the income statement under the current head liabilities section. Making the payment on the invoice for the purchase is the next critical step after recording the expenses incurred. They need to keep a close eye on all the bills to ensure they are paid on time to avoid the fees assessed for payments received beyond the due date. The seller’s account information should be included in the payment voucher that has to be filled out. Before the payment issue voucher can be sent to the vendor, there is sometimes a need for approval in certain businesses.

Put those numbers to use by building reports that help you better understand your company’s financial health and cash position. Like the history of payments report, the voucher activity report tabulates expenses into certain buckets. The difference is that you can filter the voucher activity report by additional criteria, like expenses for a specific project, department, business location, etc.

- This falling trend in the accounts payable turnover ratio may indicate that your company is not able to pay its short-term debt, and is facing a financial crunch.

- Your accrual report will show all your accrued expenses for a specific period, irrespective of payment activity.

- This will enhance the understanding level and make it easy to identify them correctly and use them for the next level of accounting process.

- When auditors look at accounts payable, they’ll want to see that you’re following AP best practices.

- Furthermore, it is recorded as current liabilities on your company’s balance sheet.

- Your supplier sends you Invoice #15 and immediately ships the products.

Your supplier sends you Invoice #15 and immediately ships the products. But with its dependence on manual entries, it’s still prone to errors and takes work to keep up-to-date. It can be ambiguous which account each line item in an invoice is connected to. If it’s a brand new invoice with a new invoice number, you may want to create a reversal transaction and then enter in the new invoice.

You need to keep a track of your accounts payable to know when the payments are due, so you can make the payments to your suppliers on time. For example, if you see that one of your suppliers offers an early 2018 refund cycle chart for tax year 2017 payment discount, perform a few quick calculations to see if your cash flow can handle making that payment early. Building this AP report is straightforward if you already have a business expense tracker.

A payable is created any time money is owed by a firm for services rendered or products provided that have not yet been paid for by the firm. This can be from a purchase from a vendor on credit, or a subscription or installment payment that is due after goods or services have been received. Another, less common usage of “AP,” refers to the business department or division that is responsible for making payments owed by the company to suppliers and other creditors. An accounts payable ledger helps you stay on top of outstanding invoices and payments.

Automated systems often have built-in security features that help protect financial data. Additionally, they can assist in ensuring compliance with regulatory requirements, reducing the risk of fines and legal issues. Balance sheet accounts are separated into current and noncurrent accounts. Learn more about how Ramp’s modern finance platform helps companies save an average of 5% a year. You submit a purchase order to your supplier for a new set of tools on August 15, 20XX.

The telephone bill is an expense – it is an event or something of value delivered that results in money flowing out of the business, either immediately or at a later date. The expense (event) has occurred – the telephone has been used in April. When the item is received, the vendor should include a shipping receipt.