Time Period Assumption Intermediate Financial Accounting I Vocab, Definition, Explanations Fiveable

From a legal standpoint, the time period assumption requires companies to adhere strictly to reporting schedules mandated by regulatory bodies. For instance, publicly traded companies are often required to submit quarterly and annual reports to entities such as the Securities and Exchange Commission (SEC) in the United States. Failure to comply with these reporting periods can result in legal repercussions, including fines and penalties. Moreover, the assumption impacts the recognition of revenue and expenses, which in turn affects tax liabilities.

Get in Touch With a Financial Advisor

The accountant needs to estimate and make an assumption on the amount which needs to record into the income statement. Companies may use different periods for their financial reporting, but it is usually based on what information they want to present about the company. Some companies use different time periods to smooth out their earnings or for other accounting reasons. It all depends on your company’s needs and what information you want to convey about your business operations through financial reporting.

Calendar Accounting Period

In other words, it means that a company has its own identity set apart from its owners or anyone else. Personal transactions of the owners, managers, and employees must not be mixed with transactions of the company. The Going Concern assumption is the only underlying accounting assumption mentioned in the IFRS Conceptual Framework for Financial Reporting. One vehicle was used for the delivery of products to customers while the other vehicle was used by Ms. C solely for her personal trips. Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances.

The time period principle and other accounting principles

Different companies may adopt different fiscal year-ends or may change their accounting periods, which can make comparisons difficult. Analysts often adjust financial statements to facilitate comparison, but this requires additional work and can introduce errors. Businesses and other economic entities record transactions and compile them using different accounting bases that best suit their preferences and needs.

- For example, consider a company that signs a contract in December to provide services over the next six months.

- The balance sheet, on the other hand, only shows a picture of the company on a single date in time.

- The matching principle, for example, requires that expenses be matched with the revenues they help to generate, which prevents companies from overstating profits in a given period.

- The choice between these two approaches depends on the specific needs and regulatory requirements of the business in question.

- Ms. B owns a cleaning services business and another business which is a chemical manufacturer.

For instance, a retail company might analyze monthly sales data to identify seasonal trends and adjust inventory levels accordingly. From an accountant’s perspective, the challenge lies in determining the appropriate cut-off points for expenses and revenues. Deciding how to allocate such costs requires judgment and can lead to inconsistencies if different periods are treated subleases and subtenants differently. Regulatory bodies, such as the securities and Exchange commission (SEC), require public companies to follow GAAP to prevent fraudulent reporting and financial misrepresentation. The matching principle, for example, requires that expenses be matched with the revenues they help to generate, which prevents companies from overstating profits in a given period.

Another reason might be because some business transactions occur over long periods while others happen very quickly. It is an accounting method that allows companies to show their earnings and balance sheets more favorably than they would be if they were using one of the other methods. However, if Mr. A, owner of ABC Company, buys a car for personal use using his own money, that transaction is not recorded in the company’s accounting system because it clearly is not a transaction of the company. Because, the electricity expense was for the month of March even if the bill has been received and paid in April. Hence, the income should be recognized in December 2021 even if it has not yet been collected as of that date. Financial statements are prepared with the assumption that the entity will continue to exist in the future, unless otherwise stated.

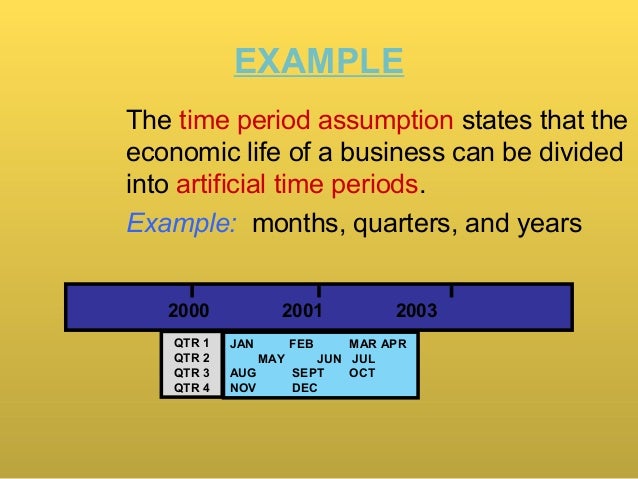

Each accounting basis can be imagined as a collection of accounting rules and principles that determine how accountants should record transactions under that basis. Subscription-based companies like streaming services use the time period assumption to recognize revenue over the subscription period. The ongoing debate around the appropriateness of the time periods chosen and the methods of accounting applied within those periods underscores the complexity and importance of this fundamental accounting assumption. The accounting period will reflect the amount of revenue and expense recording within each period. Under accrual accounting, revenue and expense are expected to record when it occurs rather than paid or collect. The transactions are not easily separate between each accounting period especially the sale and expense happen the end of the period.

Accrual accounting reflects the complexities of business transactions that extend beyond the immediate exchange of cash. For instance, if a company delivers a product in one fiscal period but receives payment in another, accrual accounting recognizes the revenue at the time of delivery. This method provides a more accurate financial picture, as it aligns income and expenses with the time period in which they are incurred. The annual and interim reporting cycles are critical components of financial reporting that allow stakeholders to regularly assess a company’s financial health and performance. The annual reporting cycle provides a comprehensive overview of the company’s activities over the past year, including detailed financial statements and management’s discussion and analysis.